How do gambling establishment earnings and betting tax operate in New Zealand? Do you as a personal individual need to pay any tax for your online gambling establishment profits?

The brief response is that gambling establishment jackpots in New Zealand are tax totally free.

Simply put, you as a personal individual do not need to pay tax on your earnings or perhaps report them to the tax authorities.

Do I need to pay tax on my gambling establishment payouts?

No, if you reside in New Zealand and have actually won cash at either regional or online gambling establishments, you do not require to report and tax these earnings.

Earnings from video games of possibility are thought about a pastime activity in New Zealand and are for that reason not taxable.

Do I need to pay tax on my earnings if I have fun with Crypto currencies?

Betting with cryptocurrencies is a relatively brand-new innovation that is not yet controlled by specific nations.

It likewise suggests that gambling establishment profits in cryptocurrency fall under the very same guidelines as other gambling establishment video games.

No tax requires to be paid when you win at an online gambling establishment that pays in cryptocurrencies.

Are all video games of opportunity tax-free?

Yes, your earnings are tax-free no matter whether you have actually won on slots, poker, bingo or lottery.

Exist exceptions for betting tax?

There is. The exception is that you earn a living from video games of possibility, for instance excellent poker gamers can make well from their video game. This can be counted as earnings and ought to be reported to the tax authorities.

Lotto jackpots should likewise be reported if you routinely win. Here Workandincome describes this!

Where can I discover details about earnings tax in New Zealand?

The Income Tax Act 2007 is the extremely most current file from the New Zealand federal government where the tax law is examined. You will discover it here!

Are gambling establishment earnings tax-free in all nations?

In Latvia, for instance, you pay 25%, in Slovenia 50% for earnings over $4000, 29% on all video games of possibility in Nigeria.

In these nations, you are personally accountable for reporting your gambling establishment jackpots and therefore paying tax on them.

Simply put, we in New Zealand are really fortunate when it concerns gambling establishment video games as we get to keep 100% of our jackpots.

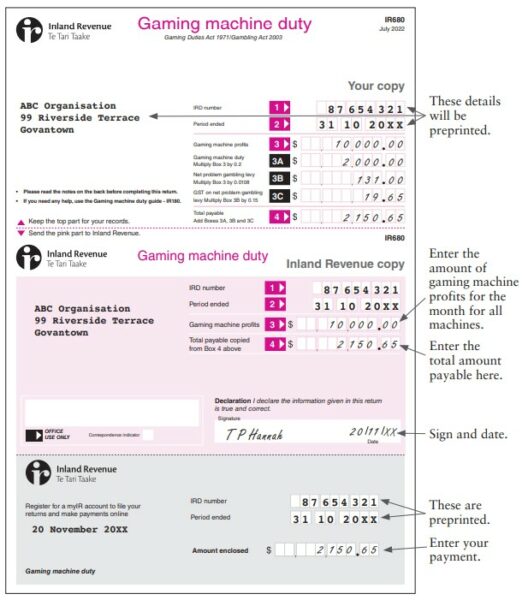

Do gambling establishments pay any betting tax?

The operators should naturally pay tax! The operators likewise do not have to pay tax in all the nations they run in, however just in the nations that have actually presented their own license system and therefore likewise tax.

earnings from overseas gambling establishments. In spite of that, it is still tax-free for gamers from New Zealand to win at these gambling establishments.

The regional stars need to pay tax in New Zealand. Listed below you see a table with the taxes a regional gambling establishment operator should pay.

| Tax | How much?Casino responsibility 4 |

|---|---|

| percent of the gambling establishment wins Video gaming device responsibility 20 percent | |

| of video gaming maker earnings Issue betting levy 0.56%off gambling establishment wins Lotto 5.5 | |

| percent of the small worth Totalisator task 0%from year | |

| 2021 | it is crucial to understand that how much tax the |

| operators pay each | year modifications depending on how the organization has actually been

doing. What is the betting act 2003 This is New Zealand’s law for carrying out gambling establishment operations online and on land. Gambling establishments require to follow this in order to lawfully perform their gambling establishment operations. Find out more about the Gambling Act 2003 here. Sources: https://www.ird.govt.nz/-/media/project/ir/home/documents/forms-and-guides/ir100—ir199/ir180/ir180-2022.pdf?modified=20220725221826&modified=20220725221826 https://austgamingcouncil.org.au/sites/default/files/2021-10/AGC%20Guide_6_NZ%20Taxation%202018-19.pdf https://www.legislation.govt.nz/act/public/2007/0097/latest/contents.html |